Cash rules everything around me. C.R.E.A.M. Get the money. Dollar, dollar bill y’all. - Wu-tang Clan

The world of personal finance is changing. Funding for fintech startups is rapidly outpacing all other categories in the startup world and newbie neobanks that offer basically the same product are spending CAC out the wazoo to compete for precious AUM. This craze has given consumers more options than ever to figure out how to manage their most stress-inducing asset (especially if your name is Jerry McGuire).

Don’t want to use Chase? Use Chime!

Don’t want to use T. Rowe Price? Use Titan!

Don’t want to use Bank of America? Use Brex!

At the outset this sounds amazing! No one loves their bank or brokerage right?

Don’t get me wrong, innovation in an industry that has largely been anti-consumer for decades is hugely positive for mostly everyone (except maybe traditional bankers). Fees have largely been reduced or eliminated altogether thanks to interchange revenue. Interest rates have decreased thanks to lower overhead in the tech world (and the Fed). The unfortunate thing though is that many of these products are just poorly reskinned, internet-first versions of the same old thing. Are the UIs more sleek? Sure. But does the in-app experience really change the excitement towards managing finances? The jury is still out.

That being said, there are a few companies that are really pushing the envelope and standing out when it comes to making money management fun. These products have largely seen great success in recent years and that’s due in large part to the completely fresh and exciting approach to things that haven’t been reimagined in decades. These funtech companies are just a taste of the future of consumer fintech!

gambling your life savings

As someone who particularly likes gambling of any kind (craps, scratch-offs, coin flips, you name it), it instantly clicks when an app comes along with the same psychological effects. Yotta, the savings app that gives you the chance at winning a $10m jackpot every week, does just that. Based on the Premium Bonds system in the U.K. (which I highly recommend you reading about if you’re unfamiliar), Yotta incentivizes users to save weekly by giving them lottery tickets for every $25 saved. These tickets have a similar format to the Powerball with a prize jackpot every week.

The thing that really gets me excited about Yotta is the key psychological concept behind the product: constructive addiction. People inherently want to play games, have fun, and win every once in a while. Since most things in society actively prevent play (hello the “traditional workplace”), many of us have to look to occasional outlets to fulfill that desire. The annual trip to Vegas, a pick-up basketball game at the YMCA, and a night out drinking at the local bar all achieve the same thing: giving our dopamine-addicted brains some respite from the monotony of the day-to-day. With a good chunk of these outlets having the potential to lead to destructive addictions (or torn ACLs if you’re over 30 and attempting to dunk), it’s even more important to add more constructive addiction into everyday life. The excitement of buying a lottery ticket, the anticipation of waiting on results, and the release of the final number draw paired with a “buy in” the helps people save more is a perfect example of the potential here.

The crypto world has been doing a similar thing for the last few years, with apps like Pool Together offering a bonding scheme with a DeFi twist. Every day, investors can deposit ETH, MATIC, or AVAX in a prize pot (or a staking pool if you’re web3 fluent) and at a set time the daily interest earned on the total pot is distributed as winnings to a select group of participants. The same psychological aspects are in play as with Yotta or Premium Bonds, pairing the possibility to turn $74 into $40,000 with a no-loss scheme injecting play in a low-risk, thrilling way.

Bond schemes aren’t the only way consumer fintech companies have been bringing casino-fueled dopamine hits to people. Startups like Fold let users spin a prize wheel after every purchase with a chance of winning 1 Bitcoin (over $40k at the time of writing this) and other prizes. While this isn’t as exciting because it incentivizes customers to spend (like rewards credit cards love to do), the gamification of rewards and in-app entertainment in consumer finance apps is definitely a trend I’m excited to see evolve.

roast the pain away

Especially after being loaded with crippling student debt and faced with the reality of never being able to own a home in a major U.S. city in their lifetime, many folks in the younger generations have become extremely disenfranchised with the modern financial system. Some choose to ignore their finances altogether and pray the debt away 🙏. Others do everything they can to fix it but in complete privacy for fear of embarrassment (if they only knew how much I spent on avocado toast each month). More recently, Gen Z has been much more forthcoming among friends and in their communities about their financial situation.

Enter Cleo, a neobank in the U.K. that brings a hilariously human touch to financial discussions.

A conversational chatbot with an attitude, Cleo does something that many of us are reluctant to do: talk about our financial situation with someone (or something I suppose). By meeting consumers where they are financially and emotionally with a sarcastic yet understanding non-human interaction, they actually unlock something that no live person-to-person interaction could. Since my therapist isn’t a financial advisor on the side, this is a great way to face my money situation in a non-threatening way.

Cleo has since expanded their offerings to become a full-fledged challenger bank that allows users to borrow, save, and budget all from the same app. The key here though is that they’ve kept their funny, irreverent brand persona consistent across their ecosystem. By bringing the personality of Cleo into something like spot loans, the entire experience is much more enjoyable for everyone involved. In the borrow section of the app the headline reads “IN THE SH*T? GET COVERED”. If that’s not the kind of person I want to borrow $50 from I don’t know who is.

invest with a crew

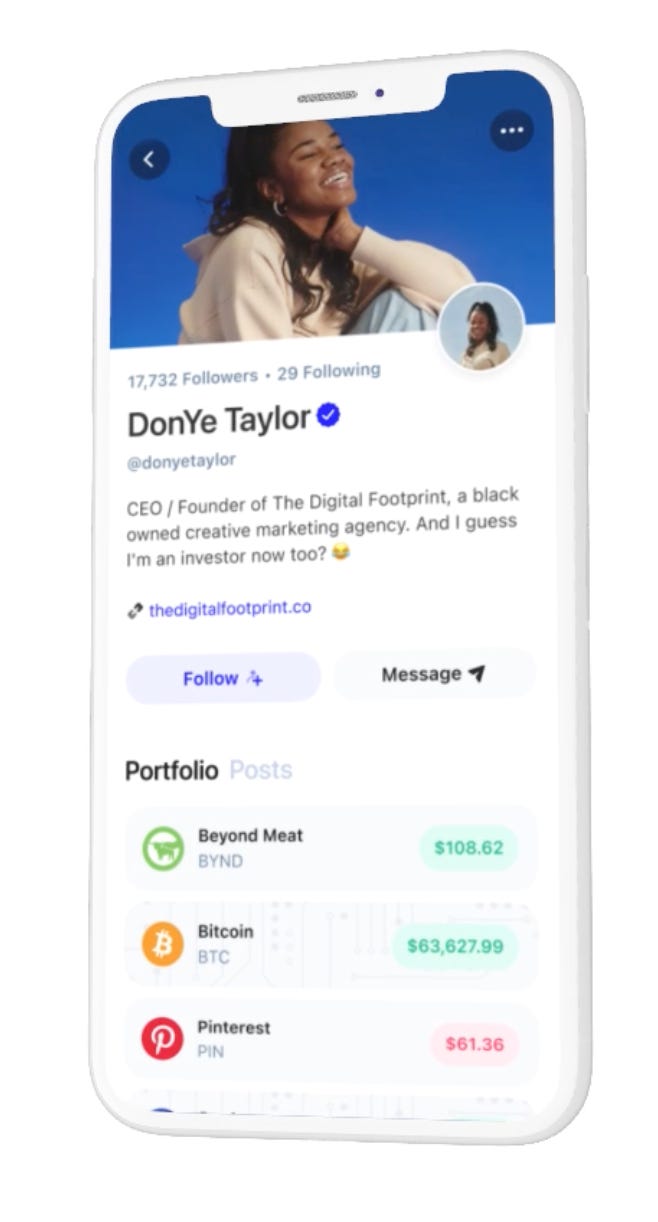

There are mixed opinions about the gamification of investing that has been championed by Robinhood and copied by others in the last few years. Regardless of where you stand in that debate, it’s a matter of fact that investing has become social and will continue to move in that direction more and more with future generations. Public has leveraged this trend by creating a community-centric approach to what otherwise would be another brokerage account.

Instead of reading about what Warren Buffett or Jack Bogle said about the merits of value investing back in the olden days, you get to see actual portfolios of friends, connections, and modern day expert influencers (although I’d still buy BRK-A if I had $500k to drop on a share). Although there is a slight fear of Instagram-like FOMO or depression-inducing comparisons to folks who’ve “made it” in the market, the social + community element in Public’s platform are a great way to get more market participants and to educate new investors. This applies for all newbies, regardless of vastly different life backgrounds. My sister who lives in the art world and my business partner who lives in the tech world both get the same utility out of following a market expert’s portfolio and getting engaged in the world of public equities investing. The fact is, it’s way more fun and accessible directly DMing someone who has beaten the S&P than it is reading Barron’s (although I do love me some Barron’s).

On the private equities side, a similar social investing trend has developed in the form of real-time, community-driven fundraising events. Unlike asynchronous chats and news feeds on platforms like Public, synchronous investing events open up the possibility to even more energy, excitement, and fun. Stonks, my favorite company in this space and mentioned back in my first article, calls themselves the “YC demo days for everyone”. Unlike the long and arduous (read: super boring) YC demo days though, Stonks is actually a really enjoyable way for angels and VCs to invest in awesome companies on the spot. By opening up the event to hundreds of simultaneous participants and limiting the companies presenting to a select few, they not only keep quality high but also put on a super entertaining production.

With blue chip investors backing them, Stonks is able to get the crème de la crème of private market investors to dive into dialogue with each other and the audience in addition to pitches from the featured entrepreneurs. This engaging content, paired with an active community chat that persists throughout the event, makes a Stonks event feel more like a show than a typical demo day. Their coup de grâce (guess I’m in a French mood tonight) is the ability to directly invest in companies through the platform in real-time. The gamification of the actual investing process with a big invest button and a live ticker of how much is being committed for each company puts this one over the edge for an amazingly delightful and sticky product. The only other product that I get a similar, fully immersive online experience with is Fan Controlled Football which I will most definitely talk about in a later article!

constructive addiction + connection

When it comes down to it, personal finance is all about human psychology. As product designers and creators, we should leverage that for good. By combining constructive addiction and a true sense of connection (even if it’s from a sassy robot) in consumer fintech tech, the future of money management has the opportunity to turn into something that people embrace instead of shirk away from. Instead of pushing high-interest credit cards on college students, we should push gamified savings vehicles on them. Instead of telling people to read Investopedia alone to get started with investing, we should tell them to join a social investing community. Money can be fun. We just have to make it so!

As always, if you’re a founder working on a fun product or know of any awesome companies that fit into this category, send them my way at hi@superduperserious.com. I’d love to meet and include them in a future post!

LOL love the insights. haven't really thought about "constructive addiction" in that light...